The sell-side quality-of-earnings (QoE) report has become a critical piece of any private equity transaction. For buyers, the sell-side QoE provides valuable insight into the projected value of a newly acquired asset and helps them determine a fair purchase price. Private equity sellers often view sell-side QoE as a risk mitigation tool, but it can be so much more than that.

By incorporating business transformation road-mapping into the sell-side QoE report, sellers can highlight synergies and transformation opportunities that can function as long-term value creators. With those insights, you are capable of showing potential buyers where additional untapped value can be found within your portfolio companies. In essence, transformation road-mapping enables you to increase the perceived value of your assets, and maximize exit value and investor returns. Obviously, any progress that can be shown is a plus!

Raise the value of your assets

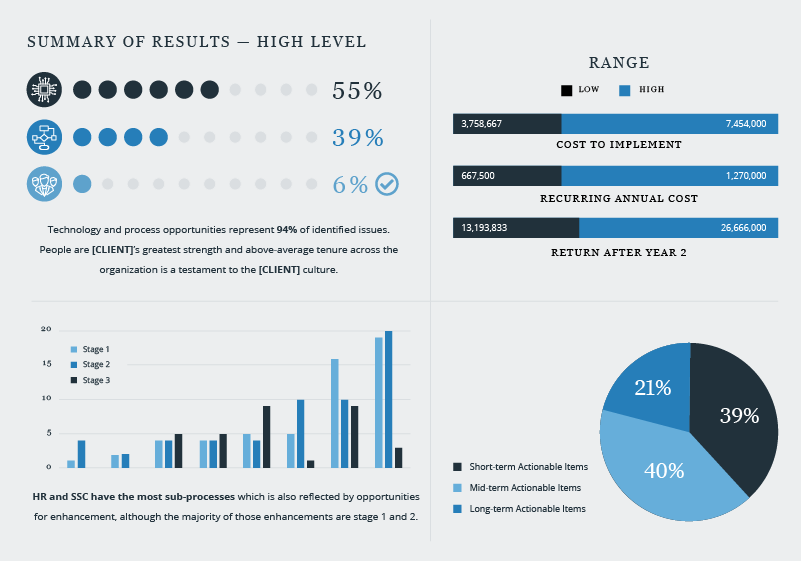

If you plan to sell a portfolio company in the coming months or years, simply having a transformation road map in place can increase the value of your asset as you approach potential buyers. Outlining where opportunities lie to reduce overhead costs and increase operational efficiencies can help potential buyers see value without a significant time investment. Ideally, firms are apt to attach specific dollar values to those transformation opportunities so buyers can calculate (and model) how much business value they stand to drive over the expected lifetime of those investments.

Case in point: As part of a recent transformation engagement, we determined that a portfolio company could remove $250,000 (recurring) from a healthcare services portfolio company by streamlining the processes used to handle critical patient referrals received from its physician network. That savings may not mean much to your firm if you’re planning to sell that company in the next 12 months, but for prospective buyers, that’s a massive expense that can be permanently removed from financial forecasts/budgets — assuming they make those changes.

By providing the “architectural blueprints” for planned or in-process optimization projects, potential buyers are more apt to include such changes in their value creation plans and valuation models.

How does it work? As we all know, buyers typically model cash flows on historical results along with synergies and changes they can incorporate to achieve those cash flows. Building the transformation road map directly into your sell-side QoE presents buyers exactly where those synergies lie, the time and cost needed to implement them and the expected return they will provide. If you don’t have those conversations with the buyer, they might ignore those opportunities or seek out those synergies themselves. If they unearth value drivers on their own, there’s no incentive to pay extra for that asset.

With that information in hand, buyer teams can build out more accurate valuation models that detail precisely how much they can afford to pay for a given asset while hitting ROI benchmarks and meeting shareholders’ expectations. In many cases where a detailed transformation road map is available, that means agreeing to pay more because decision-makers can clearly see where efficiency gains and other transformation opportunities will deliver recurring savings year after year.

Build out a detailed transformation blueprint

To start capitalizing on transformation in this fashion, you need to first build out a detailed transformation blueprint that highlights every opportunity. Running a complete diagnostic of your portfolio company’s existing processes, workflows, technology and labor will give your firm a clear picture of where those factors can be improved upon — either through updates, augmentation or elimination.

Many private equity firms don’t have the in-depth expertise with business transformation and all of its related factors — automation, technology stacks, finance functions, upskilling workforces, process enablement — to fully map out every opportunity. Working with an experienced transformation partner like CFGI will not only bring those transformations to light, but attach cost and ROI expectations for each change.

A typical impact assessment report from CFGI takes only about 3 weeks but outlines various details about each transformation opportunity:

- Cost to implement.

- Recurring cost to manage.

- Level of disruption to make that change.

- Expected savings.

- How quickly that change can be implemented.

Each of these criteria is rated as either low, medium or high from “ease of implementation” and “value” perspectives, so your firm can clearly see which transformations to prioritize. Targeting the low-hanging fruit — ideally, a transformation that scores low on cost to implement and high on expected savings — will show prospective buyers where they can get even more value out of that asset. CFGI breaks down in dollar figures exactly how much you or the buyer can expect to save with each change. That, in turn, should allow your portfolio company to build more aggressive budgets and forecasts for your portfolio companies, which will then drive up the asking price for those assets.

These opportunities can be found all over the enterprise. CFGI’s diagnostic covers a lot of ground, targeting different processes and workflows including, but not limited to:

- Accounts payable.

- Billing.

- Compliance.

- FP&A.

- HR.

- Payroll.

- Procurement.

- Real estate.

- Tax processes.

The sheer scope of these diagnostic reports gives your firm more opportunities to support management-EBITDA add-back when it comes time to sell an asset. While the odds of getting credit for savings you haven’t seen yet are certainly higher if you have already begun the transformation process, that’s not always the case. After they have combed through your transformation blueprint and run their own internal valuation analysis, buyers may decide that the portfolio company is worth more than originally expected and, as such, are willing to pay more for it.

In other words, your firm gets paid for transformation without actually doing it. Whether you’re ready to launch an end-to-end business transformation initiative or simply want to focus on the low-cost changes that will deliver high ROI, mapping out a transformation strategy can be extremely profitable in and of itself. As you can see, that includes creating blueprints for portfolio companies that your firm may not even hold onto for the long term. Highlighting transformation opportunities will help increase the perceived value of your assets and increase the asking price when it comes time to sell.