What does forecast accuracy mean, and why is it important for your organization? Read on to learn more.

What is the definition of forecast accuracy?

At first glance, defining forecast accuracy can seem fairly straightforward: This metric refers to the deviation in value, measured in dollars and percentage basis, between your forecast and the actual results. However, there’s an important distinction to be made between the different kinds of forecast errors you may observe. An overambitious estimate — one in which your forecasting is higher than the actual results your business achieves — is very different from its opposite. Accuracy is measured by deviation in either direction and while overperforming against your benchmark is always a good thing, a consistent forecast error is never a good sign.

This is referred to as beating or missing the target. A forecast error in which you exceed your prediction can be said to beat the estimate. When you fall short, that’s a miss.

It’s important to remember that as a public organization, you shouldn’t set forecasts that are considered too conservative by Wall Street. If you consistently beat forecasts, but Wall Street doesn’t consider your forecasts ambitions enough, you will be penalized in the market by investors. The fact is that investors want to see both ambitious and accurate targets.

Factors that influence forecast accuracy and introduce error

There are various internal and external realities that can impact forecasting accuracy:

- Internal factors include company-specific concerns related to operational issues. For example, data related to a headcount plan will influence your operating expenses forecasting. However, if your hiring speed proceeds at a different pace than you anticipate, this could result in a deviation. Likewise, if new product launches are delayed because of manufacturing issues, the demand may exist, but you might not have the inventory necessary to fill it. On the other hand, you may be ready to expand your sales channels, but your demand forecasting could be off. Forecast bias could mean that you don’t properly understand how your existing products and services will perform in a new market.

- External factors are broad and varied. From supply chain issues to macroeconomic trends, there’s no shortage of outside forces that can influence demand and impact your business’s ability to deliver. New regulations, especially in fields like biopharmaceuticals, can alter timelines and mean that your initial projections need to be updated. Consumer preferences can also shift with the trends. While you need to be able to use these external factors to inform how you measure performance and develop new forecasts, some level of unpredictability is inevitable.

How do you measure forecast accuracy?

At the simplest level, to measure forecast accuracy, you just compare a forecast to the actual results. However, a deeper analysis is required to determine how and why a forecast error occurred. Did internal bias affect demand forecasting? Did a global supply chain issue result in a lack of inventory, despite your company having an accurate impression of demand?

It’s important to dissect the forecast in its entirety, down to specific line items and inputs. When you discover the origins of a forecast error, you can adjust your processes accordingly, thus improving forecast accuracy.

Often, when you assess specific demand inputs, you’ll be able to find out what’s producing a particular forecast error. If an error is due to an operational issue with the business, you can make a plan to fix it. If it’s a poor input assumed in the company’s financial model, the finance and operational team (e.g., the functional department closest to the assumption/input) should coordinate with one another to understand why the assumption was incorrect – what was the underlying data that supported the assumption? Combing through the data and diving all the way down to the lowest-level components will help you avoid repeating this error in the future.

Types of forecasting methods

There are two main approaches to developing a forecast:

- Bottom-up strategies: This technique requires you to have a specific and definable input(s) for every line item. Typically, you need to have access to a large volume of historical data to help you fill in the gaps with an average or mean and understand how the business has performed historically. However, it’s also important that inputs are also based on the current and future circumstances of the business. Your analysis will extend to every project and department while incorporating real information related to headcount builds and various revenue/cost drivers.

- Top-down strategies: In this method, you’ll start with a macroeconomic approach, using a high-level view of the situation. Instead of relying on granular inputs on projects and department basis to determine a mean value for each input, many companies may have to turn to figures gleaned from their competitors and peers to determine revenue percentages, operating expenses and more.

In reality, these two methods are not diametrically opposed. Overreliance on either one can produce a forecast error. The best planning should take both bottom-up and top-down approaches into account.

An error in forecasting: Where does it come from?

The source of a forecast error will vary based on numerous factors, including the type of company in question and the industry in which it operates. Your business needs to ensure that it has accurate assumptions for the key inputs that drive your forecasts, such as retention for SaaS and Average Order Value for CPG.

To highlight a few specific potential sources of error, consider a SaaS company. An important consideration for many of these organizations is retention forecasting, given that high retention rates indicate that your product or services provides high value to your customer base and is a leading indicator of future growth. Conversely, low retention rates may indicate that your customers are not seeing the full value of your product or service.

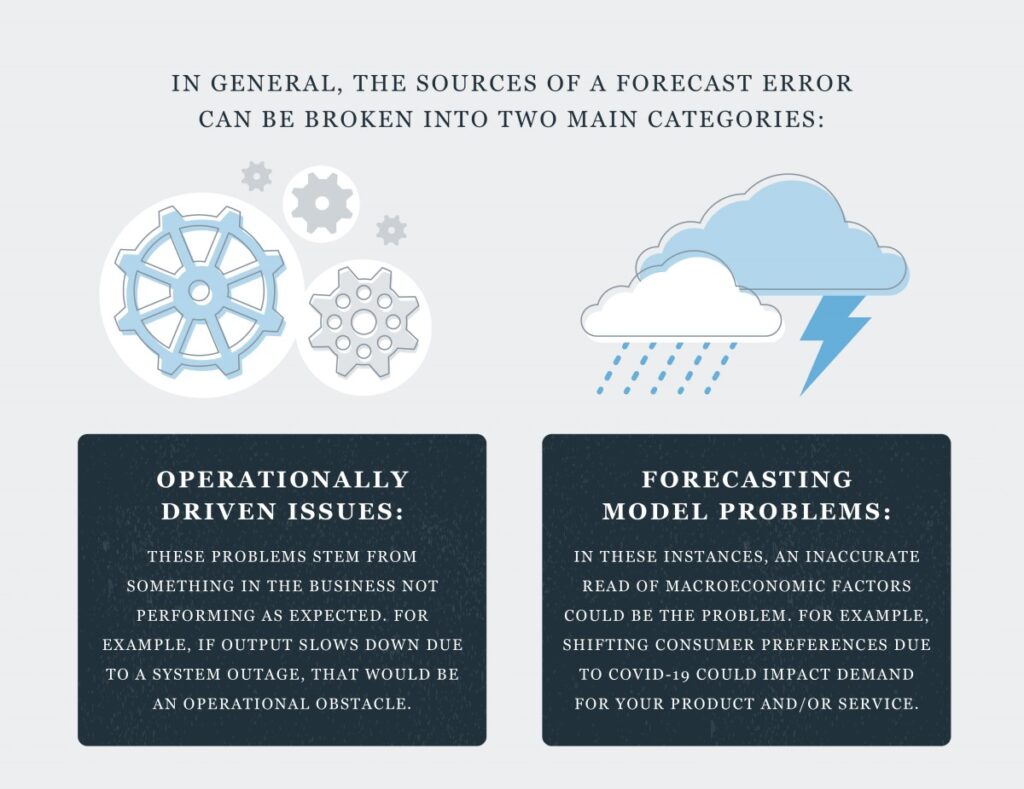

In general, the sources of a forecast error can be broken into two main categories:

- Operationally driven issues: These problems stem from something in the business not performing as expected. For example, if output slows down due to a system outage, that would be an operational obstacle.

- Forecasting model problems: In these instances, an inaccurate read of macroeconomic factors could be the problem. For example, shifting consumer preferences due to COVID-19 could impact demand for your product and/or service.

Why customer demand might change

Demand forecasting is both an art and a science. Nailing this vital process can help you ensure strong overall forecast performance, but demand can change suddenly. Why does that happen, and what does a change mean?

As you read over the data from one month or quarter to the next, the list of possible reasons for a shift in demand could be nearly endless. Public relations issues, changing pricing structures or the introduction of competing products could all impede accuracy. It’s essential that you install a measure for counteracting potential internal bias as you seek to understand the data.

Often, you’ll need to tap your marketing and strategy departments to get their opinions on customer preferences and market dynamics, leading to new initiatives and product positioning as well as insightful ideas for how to align your available solutions with openings in the marketplace. Planning for innovative product development is also a crucial component.

What is a good forecast accuracy percentage?

It might seem like the best forecast accuracy percentage is obviously 100%. However, the best forecast accuracy percentage for your business is completely subjective and depends on many different factors, including unique company needs, industry and more. There isn’t a one-size-fits-all percentage that dictates success for every company.

Yet, any miss can have an impact on your business’s shareholder value and other important factors, regardless of whether the data still shows growth. For a recent example, Chewy’s shares dropped after results for the second quarter of 2021 came in lower than expected, with third-quarter projections also underperforming compared to investors’ expectations. CNBC reported that this occurred even with a 27% year-over-year rise in revenue during the second quarter.

Why forecast accuracy is important for public readiness

If a private company experiences a forecasting error, the business can figure out how to resolve the problem out of the public eye. Experts within the organization can focus on reassessing their forecasting procedures and locating the source of their error by thoroughly examining all of the available data.

Public companies don’t have that luxury. These entities face a heightened level of scrutiny, and a consistent forecast error will also impact their financing options and their stock value — issues that largely wouldn’t be a concern for private companies who are struggling to get their forecasting right.

With an obligation to release results quarterly and an expectation to release guidance quarterly (for U.S listed companies), public companies also experience a compounding effect if they aren’t able to improve accuracy related to how they measure demand and anticipate earnings outcomes prior to a public event. Issues stemming from these concerns can also impact the overall effectiveness of the financial planning and analysis (FP&A) function.

Why should I measure forecast accuracy?

It’s important to assess how accurate your forecasts are so you can ensure that you will have continued access to capital and continuously increase shareholder value. Forecasts ultimately dictate how capital is allocated within an organization and having detailed insight into forecasting accuracy is typically a driver for capital reallocation within a business (e.g., shifting money from one area of the business to another). Improving your processes before going public will help you streamline operations before you’re required to reassess your data and examine potential sources of bias in a public arena. A better understanding of future demand can also help you lay a strong foundation for extended planning and analysis (xP&A), supporting your finance function in a way that adds actual value to the company’s overall operations.

On a more granular level, a thorough understanding of demand, supply chain issues and related concepts will mean that you’re in a better position to improve operations. You’ll have the information you need to make sure that you have sufficient inventory available to meet customer sentiment, for example.

If you’re ready to take a holistic look at your finance department to learn how you can undertake a transformative process that sets the stage for continued success, take a look at our latest whitepaper.

Acknowledgements – We would like to thank the following contributors:

- Rob Rosenwein, Senior Manager, Business Transformation – Strategic Finance & Analytics