Private equity deals are happening faster than ever: Since the start of 2021, 6,004 deals closed for $787.6 billion. In fact, current deal count and value totals are already above the highest-ever full-year numbers, with industry veterans expecting even more growth to close out the year.

At the same time, most firms are also engaging in more add-on acquisitions, which are often completed within months of the initial platform transaction. In this environment, it’s easy for management to expend so much energy getting the deal done that there’s nothing left in the tank to devote to the initial transition period.

The first 100 days following an acquisition are a critical period for private equity sponsors and their newly-acquired portfolio companies. Sponsors and management teams must team to address a variety of demands involving people, process and technology within a short window in order to reap immediate benefits, comply with reporting requirements and set the acquisition up for long-term value creation.

Given the rigors of the acquisition process itself and how much work goes into closing a deal, management teams sometimes do not have the bandwidth to tackle all of these important to-do items on their own. In fact, they may not even know where to begin or what work they should prioritize during this period. In many cases, these responsibilities fall onto the CFO’s shoulders. With so much on their plates already, how can CFOs possibly hope to check every box in the early stages of private equity acquisition to guarantee success and invoke confidence?

This guide provides some insight into the main obligations to zero in on during the first 100 days post Closing as well as best practices to adhere to so you can maximize value creation both in the short and long terms.

Assess strategic and operational needs

Whether the portfolio company is a platform or add-on acquisition, it needs to adapt to its new ownership structure. That will almost certainly require a great deal of work to integrate systems, align reporting, update processes, train personnel and fill staffing gaps. As important as it is to prioritize the immediate transitional demands, private equity firms cannot lose sight of their future state goals and need to start laying the groundwork to maximize value creation down the road.

Knowing the best place to start is essential, but many firms struggle to determine the best way forward. In truth, required updates, high priorities and transformation opportunities will all vary depending on the portfolio company’s specific circumstances. While there are some general best practices to follow, firms will find that their transition strategy needs to be tailored to each circumstance and acquisition.

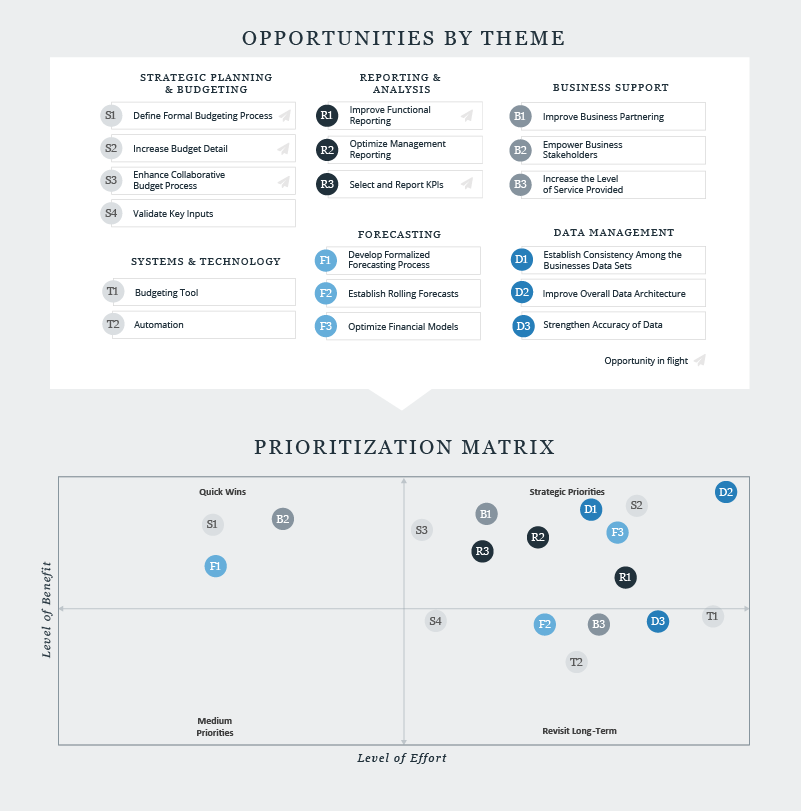

It is critical that private equity firms conduct a rapid diagnostic to quickly understand what work needs to be done and how quickly to put different transformation projects in place and what enhancements to target to deliver the most value possible. This assessment should highlight the cost and time needed to execute certain transformation opportunities, as well as the expected value created once completed, helping firms decide which projects will give them the biggest and most immediate return. This can also help firms determine if they should tackle business transformation opportunities in phases or complete all of that work at once.

Depending on the maturity of the portfolio company, it may not be ready to jump feet first into business transformation — there is still some work to be done before it can devote time and resources into those kinds of projects. The rapid diagnostic will align stakeholders around what fundamental work needs to be done in the short-term to build for the future later on.

Create a detailed transformation roadmap

There’s no doubt that the early days of any private equity acquisition involves some degree of brute force work. With so much to get through, it’s virtually impossible to avoid throwing bodies at some of the time-consuming tasks and powering through them as quickly as possible.

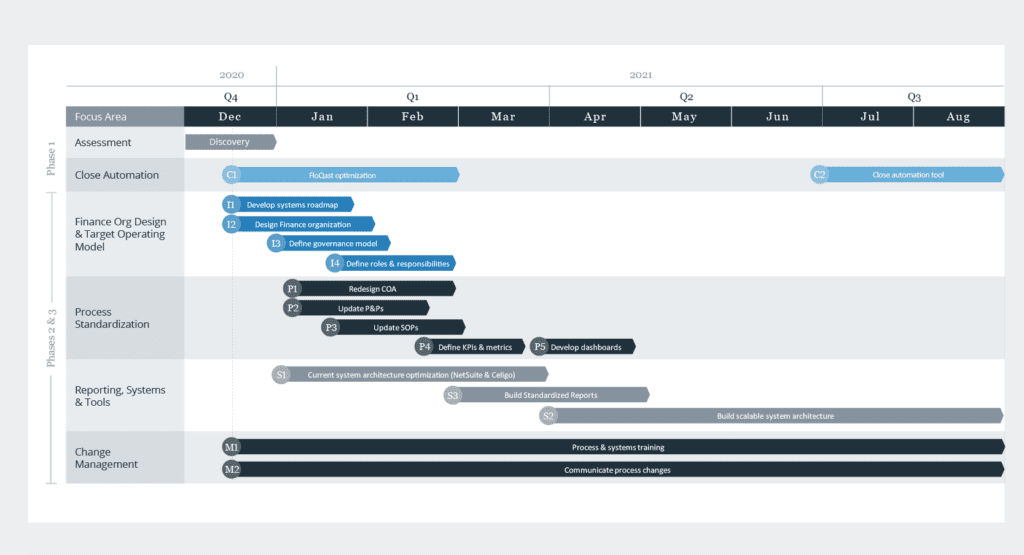

Even so, every organization should have a thorough plan of action to strategically use available resources, distribute work to different stakeholder teams and balance immediate concerns with long-term goals. It’s important to take a thoughtful approach to the transition period and fully lay out a roadmap to the desired future state of the portfolio company.

Although there will always be some degree of variability to these types of projects, firms can develop standardized approaches to execute some of the common requirements across most transactions to work through those tasks more efficiently and quickly. The only way to streamline acquisition requirements at a high level is to run everything through a project management office. Again, there is so much ground to cover, firms need a central stakeholder to oversee everything and coordinate efforts and interdependencies across different stakeholders.

Follow first 100 days best practices

A rapid diagnostic will highlight different processes and technologies to enhance, but there are also several improvements that virtually any organization could benefit from. Regardless of the specific circumstances of an acquisition, it’s always a good idea to work these tasks into the business transformation roadmap:

Workflow automation

Automate rules-based, repeatable tasks that require a great deal of time to manually complete. A rapid diagnostic will highlight both the low-hanging fruit that will deliver fast ROI as well as automation candidates that support more extensive business transformation later on. Some processes to consider include account reconciliations, data collection and invoice validation.

FP&A

Financial planning and analysis (FP&A) is a hallmark of any high-performing finance organization, and it’s very important that portfolio companies put an FP&A cadence in place, if they haven’t already. To that end, begin implementing business intelligence tools such as dashboards and analytics platforms to support this core function.

Reporting

Portfolio companies face a completely different world after the acquisition. They have new stakeholder goals that need to be met as well as performance expectations to track and report against. It’s important to align reporting requirements around shared metrics and address any data management and quality issues as quickly as possible.

Financial close

Increasing the speed and rigor of the monthly financial close is a necessity. Portfolio companies can speed this process up by filling organizational gaps and automating manual tasks. The types of enhancements needed to close books in a more timely manner will also feed into broader transformation initiatives down the road.

Also be sure to prioritize the planning of other necessary workstreams that must be completed following an acquisition, including: preparing the Closing Statement and opening balance sheet (“purchase accounting”); completing valuations of tangible and intangible assets; etc. It’s far better to account for transactions while they are still fresh – and before the auditors come calling. Proper handling of the transaction accounting can also result in lower initial-year audit fees.

Take the first 100 days one step at a time

Those first 100 days after an acquisition are a frenzy of activity, and it’s easy for even the most experienced management teams to feel overwhelmed. Establishing a systematic approach to this critical time will help firms get a handle on the transition of ownership, identify immediate obligations and map out a long-term transformation strategy.

A rapid diagnostic provides the insights needed to make smart, strategic decisions so firms can seamlessly incorporate new acquisitions into the broader organizational structure and maximize value creation during those first few months and into the future. Contact CFGI’s experienced private equity consultants to schedule a rapid diagnostic today.